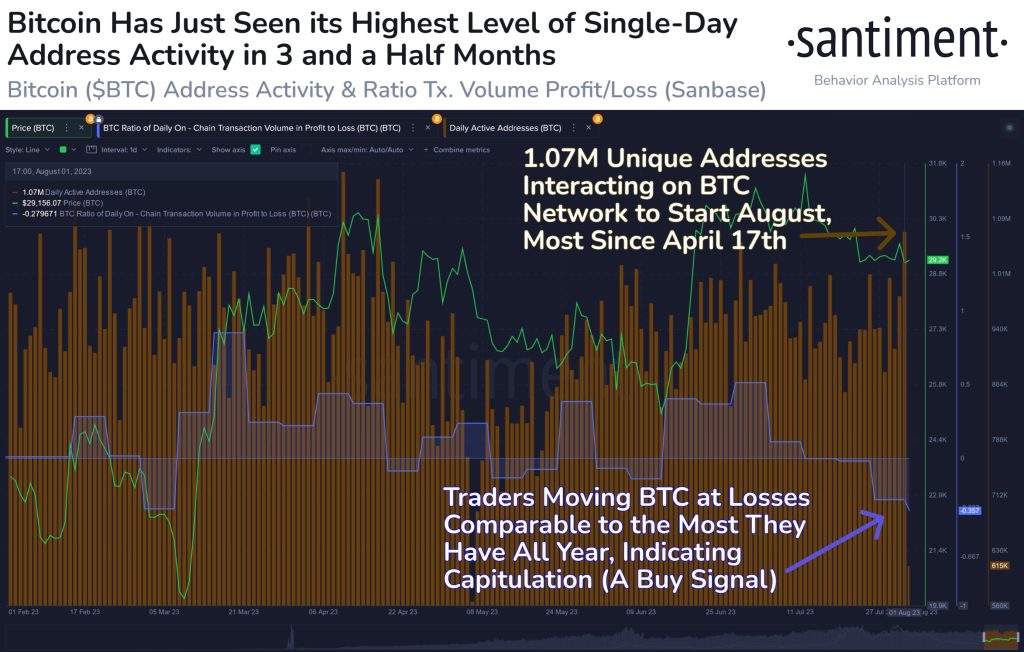

In August, Bitcoin’s address activity experienced a notable surge, reaching its highest level in 3.5 months, with approximately 1.07 million unique addresses integrating into the Bitcoin network. This influx of new addresses represents the most significant growth since April 17th. The increased utility on the network is a positive indicator for the cryptocurrency’s adoption and usage.

Capitulation (Buy Signal)

This rise in address activity, when combined with major loss transactions and negative sentiment in the market, could be interpreted as a sign of capitulation among some investors. Capitulation often occurs when market participants, facing losses and negative sentiment, give up hope and sell their positions. However, from a contrarian standpoint, capitulation can be seen as a strong buy signal. It suggests that many weak hands have exited the market, leaving room for potential buyers to step in and support the price.

Potential Short-Term Price Bounce

The confluence of these factors might imply a higher probability of a short-term price bounce for Bitcoin, at least in the near future. It indicates a potential shift in sentiment and renewed interest from buyers, potentially leading to increased demand and upward price movement.

Technical Factors

Despite these indications, it is important to approach the market with caution and consider other fundamental and technical factors that could influence Bitcoin’s price. The cryptocurrency market is highly volatile, and while certain signals might point to potential price movements, it is not a guarantee of future performance.

Conclusion

Investors should conduct thorough research and analysis before making any decisions, as the cryptocurrency market can be influenced by a wide range of factors, including regulatory developments, macroeconomic trends, and overall market sentiment. As always, it is advisable to exercise prudence and risk management while engaging in any form of investment.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news!

Image Source: strelok/123RF // Image Effects by Colorcinch