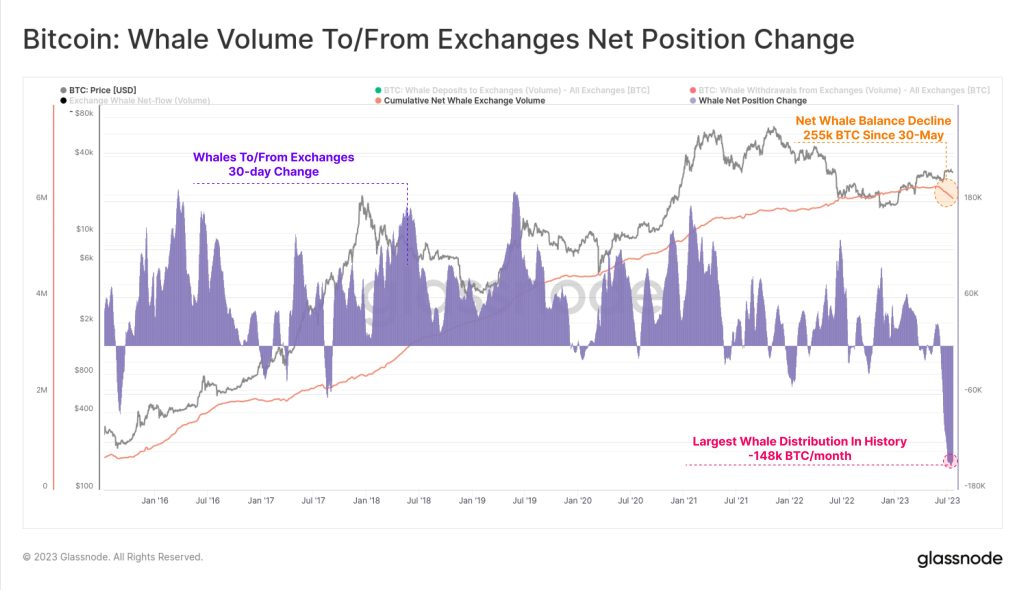

The substantial decline of -255k BTC in the aggregate Whale balance since 30 May is a significant event in the world of cryptocurrencies, particularly in Bitcoin. The monthly balance decrease of -148k BTC is unprecedented and raises several important points that warrant further investigation.

Potential Impacts

Firstly, the actions of Whale entities can have a profound impact on the cryptocurrency market. Whales, which are large holders of Bitcoin, have the potential to influence prices through their buying and selling activities. Such a substantial reduction in their overall holdings may indicate a shift in their investment strategies or risk appetite. It is essential to explore the potential reasons behind this decline, as it could be indicative of changing market sentiment or a shift in the investment landscape.

Secondly, the decline could be linked to increased regulatory scrutiny or market interventions. Governments and financial authorities worldwide have been closely monitoring cryptocurrencies due to concerns about their potential impact on financial stability and the potential for illicit activities. If there have been regulatory actions or crackdowns on certain Whale entities, this could explain the sudden decrease in their holdings.

Broader Trend Of Distribution

Moreover, this decline might signal a broader trend of distribution, where Whales are redistributing their Bitcoin holdings to a wider range of participants. Such a shift could lead to a more decentralized ownership structure, potentially reducing the risk of market manipulation by a few powerful entities.

Lastly, it is crucial to consider external factors that might have influenced this decline. Geopolitical events, macroeconomic conditions, or technological advancements could have impacted the behavior of Whales and their decision-making processes.

Final Thoughts

In conclusion, the unprecedented monthly decline of -148k BTC in the aggregate Whale balance signifies noteworthy shifts within the Bitcoin Whale cohort. Understanding the reasons behind this decline is vital for both investors and regulators as it can provide valuable insights into the dynamics of the cryptocurrency market. Further research and analysis are necessary to grasp the full implications of this event and its potential effects on the broader cryptocurrency ecosystem.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news!

Image Source: onemilliondreams/123RF // Image Effects by Colorcinch